reverse sales tax calculator florida

Divide the tax rate by 100. Add one to the percentage.

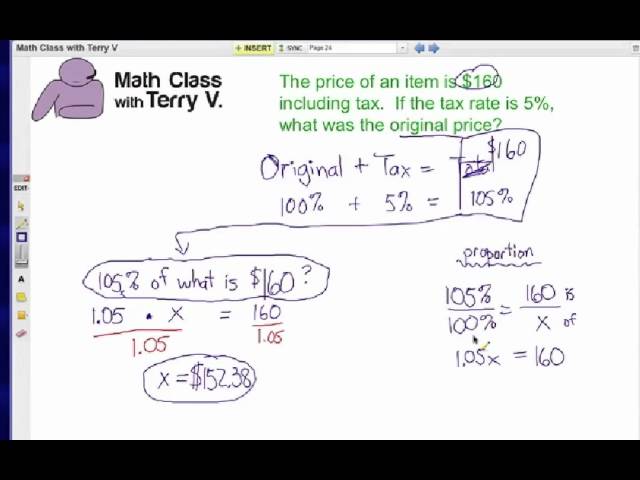

How To Find Original Price Tax 1 Youtube

139535 1075 1298.

. 375 the decimal equivalent would be. Use tax is due on the use or consumption of taxable goods or services when sales tax was not paid at the time of purchase. To easily divide by 100 just move the decimal point two spaces to the left.

Now find the tax value by multiplying tax rate by the before tax price. If you buy a taxable item in Florida. Selling Price Final Price 1 Sales Tax Reverse Sales Tax Definition Have you ever wondered how much you paid for an item before the sales tax or if the sales tax on your receipt was correct.

This script calculates the Before Tax Price and the Tax Value being charged. Enter the sales tax percentage. So if the tax rate were 7.

4 on amusement machine receipts 55 on the lease or license of commercial real property and 695 on electricity. Finding how much sales tax you paid on an article is quite easy but knowing the actual cost requires a reverse calculation. Divide sales tax percentage by 100 to get decimal equivalent of rate.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Now you can find out with our Reverse Sales Tax Calculator Our Reverse Sales Tax Calculator accepts two inputs. Divide the final amount by the value above to find the original amount before the tax was added.

Enter your before tax purchase price followed by the sales tax rate in your area. Florida has a 6 statewide sales tax rate but also has 367 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1037 on top. So divide 75 by 100 to get 0075.

Tax 6200 0075. The document has moved here. 1 0075 1075.

A tax of 75 percent was added to the product to make it equal to 35473925. Divide the final amount by the value above to find the original amount before the tax was added. Reverse Sales Tax Calculator Remove Tax.

Please check the value of Sales Tax in other sources to ensure that it is the correct value. Multiply the taxable price by the decimal equivalent of rate. 75100 0075 tax rate as a decimal.

Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax Amount without sales tax GST rate GST amount Amount without sales tax QST rate QST amount Margin of error for sales tax An error margin of 001 may appear in reverse calculator of sales tax. We can not guarantee its accuracy. Tax 465 tax value rouded to 2 decimals.

Input the Final Price Including Tax price plus tax added on. Enter the sales tax and the final price and the reverse tax calculator will calculate the tax amount and price before tax. That entry would be 0775 for the percentage.

Tax 13999 0075. Sales Tax Calculator Reverse Sales Tax Calculator Sales Tax 100 After Tax Price 1100 Sales Tax Price Before Tax Price After Tax Sales TaxPrice Before TaxPrice After Tax025050075010001250 Sales Tax Calculator This sales tax calculator is simple. Tax 104993 tax value rouded to 2 decimals.

Add one to the percentage. 75100 0075 tax rate as a decimal. A tax of 75 percent was added to the product to make it equal to 139535.

So divide 75 by 100 to get 0075. Adjustable Rate Mortgage Calculator. To easily divide by 100 just move the decimal point two spaces to the left.

Reverse Sales Tax Calculator. Firstly divide the tax rate by 100. 1 0075 1075.

Input the Tax Rate. How to Calculate Reverse Sales Tax Following is the reverse sales tax formula on how to calculate reverse tax Price Before Tax Final Price 1Sales Tax100 Tax Amount Final Price - Price Before Tax. If you know the total sales price and the sales tax percentage it will calculate the base price before taxes and.

For instance in Palm Springs California the total sales tax percentage including state county and local taxes is 7 and 34 percent. Floridas general state sales tax rate is 6 with the following exceptions. The second script is the reverse of the first.

52 rows This reverse sales tax calculator will calculate your pre-tax price or amount for you. Now find the tax value by multiplying tax rate by the before tax price. In case you are interested in doing calculation manually here is how to calculate sales tax.

Firstly divide the tax rate by 100. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Florida local counties cities and special taxation districts. The reverse sales tax calculator is the easiest and very handy calculator for computing the actual price if you input the sales tax rate and the sale price you paid for a good or service.

Reverse Sales Tax Formula.

Kentucky Sales Tax Calculator Reverse Sales Dremployee

Gst Composition Scheme May Come Under Reverse Charge Mechanism

Real Estate Capital Gains Calculator Internal Revenue Code Simplified

Real Estate Property Tax Constitutional Tax Collector

Reverse Sales Tax Calculator 100 Free Calculators Io

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Sales Tax Guide For Online Courses

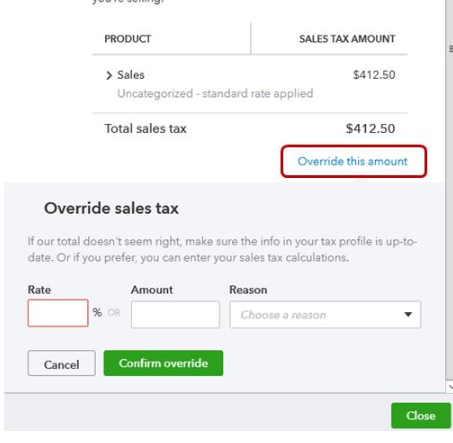

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

Florida Sales Tax Calculator Reverse Sales Dremployee

Reverse Sales Tax Calculator De Calculator Accounting Portal

Us Sales Tax Calculator Reverse Sales Dremployee

The Impact Of Hybrid Work On Commuters And Nyc Sales Tax Office Of The New York City Comptroller Brad Lander

Florida Car Sales Tax Everything You Need To Know

Reverse Sales Tax Calculator 100 Free Calculators Io

Florida Business Owner Pleads Guilty To Tax Evasion Faces Federal Prison

How To Pay Sales Tax For Small Business 6 Step Guide Chart

Shopify S Sales Tax Liability And Nexus Dashboard Results Explained Taxvalet