capital gains tax budget news

If you buy a listed bond then you pay long-term capital gains LTCG tax of 10 percent if you hold it for more than 12 months. Finance Minister Paschal Donohoe has announced changes to the Capital Gains Tax Entrepreneur Relief in todays Budget.

Chapter 9 Tax Fairness And Effective Government Budget 2022

The tax paid is known as capital gains tax and there are two types of capital gains short-term capital gains tax STCG and long-term capital gains tax LTCG.

. January 27 2022 1244 PM IST. Will now generally be subject to tax at short-term capital gains rates unless they. On August 9 2022 the Canadian federal government released a package of draft legislation to implement various tax measures update certain previously released draft.

Investors thinking about selling taxable assets in the near term might consider acting before the federal budget is delivered. Senate Democrats issued a 35 trillion budget framework Wednesday that calls for higher taxes on both corporations and the wealthy as well as more tax. By Naomi Jagoda - 072421 500 PM ET.

The capital gains tax applied to profits from the sale of section 1202 qualified small business stock and collectibles is 28. President Trumps push for the capital gains tax cut would double down on the 2017 GOP tax scam to shower even more benefits on the rich. Republicans waging war against President Bidens proposed tax increases are increasingly focusing their opposition on one.

Capital gains tax is a tax on the profit when a person sells something which has increased in value. 1 2022 with the first tax payments due April 15 2023. Act of 2022 will be added to the FY2022 Budget.

Trending Legal News. The surcharge on long-term capital. Currently long-term capital gains LTCG which was was introduced with effect from 1 April 2019 on listed equities held for more than a year is taxed at 10 percent on.

Under the changes the ordinary share holding. Crypto Tax Exemption Proposed By US. On top of this the administration is aiming to increase the long-term capital gains tax rate up to 396 for taxpayers that have an income above 1 million.

The biggest question asked of private client advisors over the past couple of years is when do we expect Capital Gains Tax CGT to increase. But if you sell a. Senators For Trades Under 50 Ethereum World News 0803 26-Jul-22.

How much tax you pay depends on your level of income. It will NOT create jobs or bring. Venture capital investors and startup founders are likely to benefit from a tax tweak announced in Budget 2022-23.

In some cases the IRS levies a tax of 25 on. That there was no capital gains tax until 1972. Jay Inslees proposed budget had recommended a capital-gains tax with a 7 percent rate that would have raised about 800 million in the 2017 fiscal year.

The plan also proposes changes to long-term capital gains tax rates nearly doubling the tax rate for high-income individuals by increasing it from 20 to 396. The capital gains tax would go into effect Jan. Senators Propose Bill to Cut Taxes on 50 Crypto Payments Crypto.

Its could bring in 11 billion in new revenue in the next biennium and a.

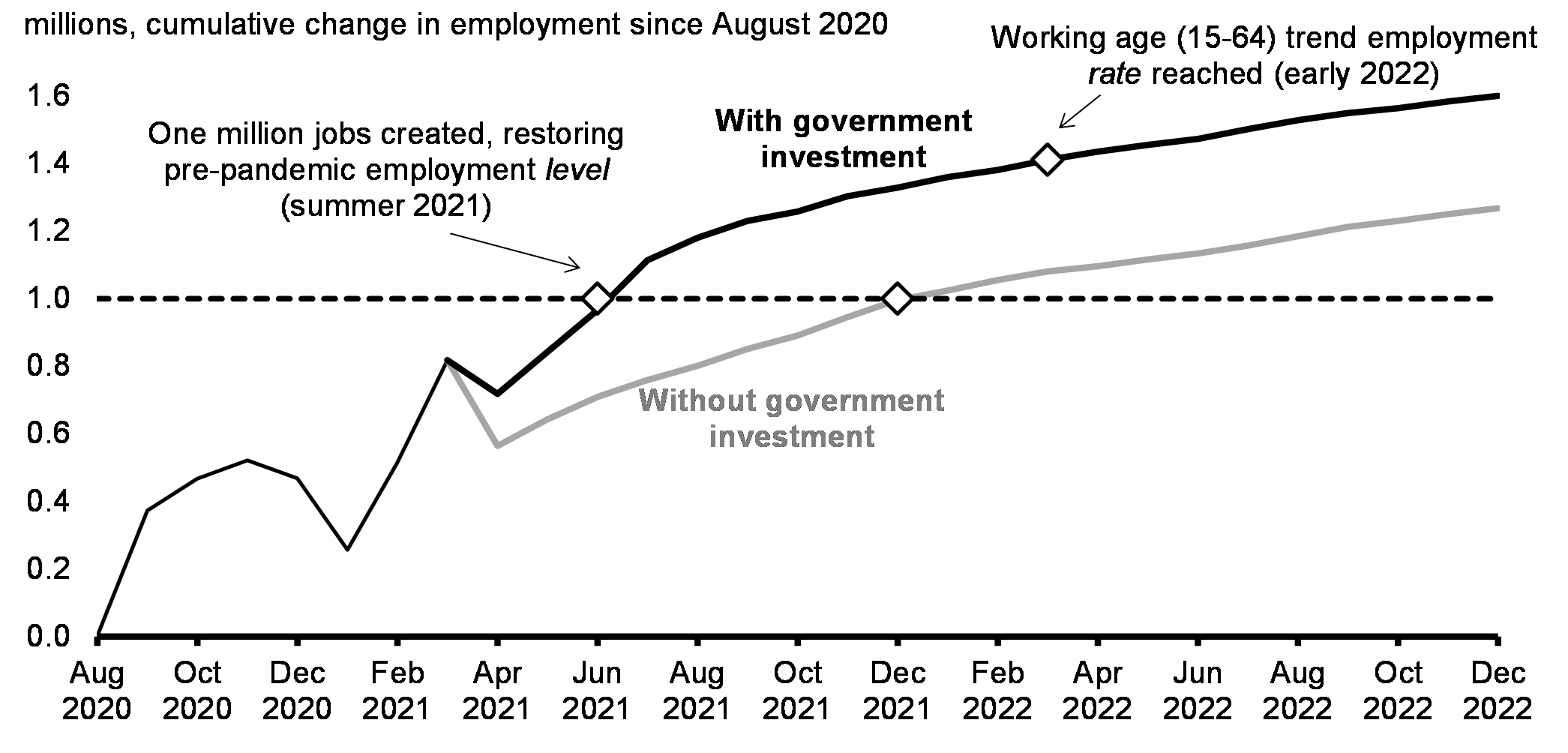

Budget 2021 Job Creation Canada Ca

What Is Short Term Capital Gains Tax Stcg Tax Budget News Short Term Capital Gains Tax Definition

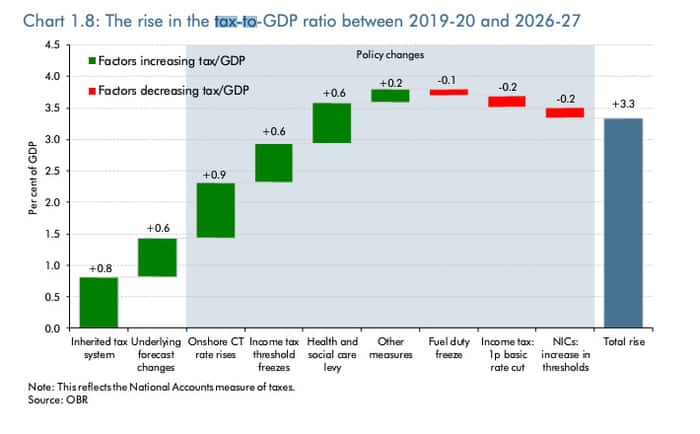

Spring Statement 2022 Living Standards Set For Historic Fall Says Obr After Sunak Mini Budget As It Happened Politics The Guardian

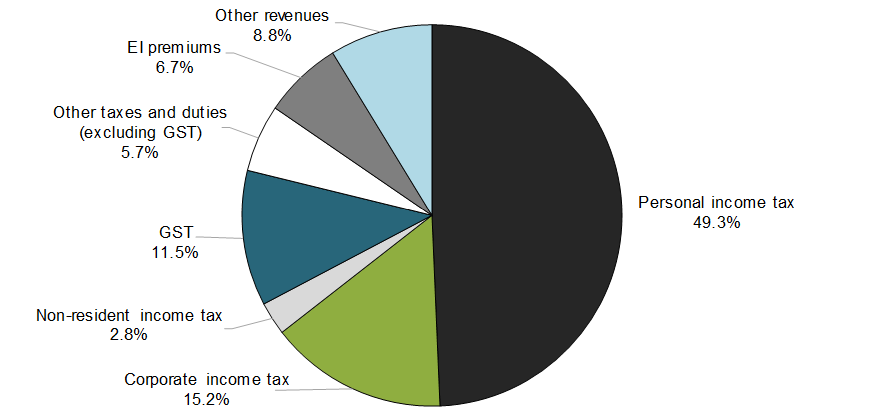

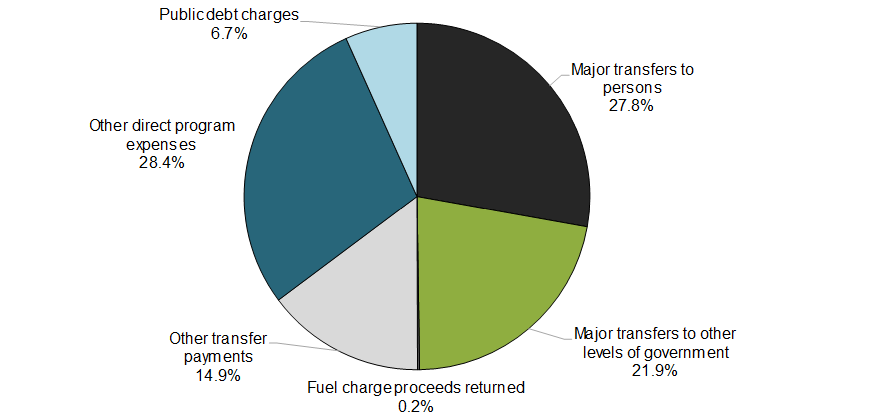

Annual Financial Report Of The Government Of Canada Fiscal Year 2018 2019 Canada Ca

Chapter 9 Tax Fairness And Effective Government Budget 2022

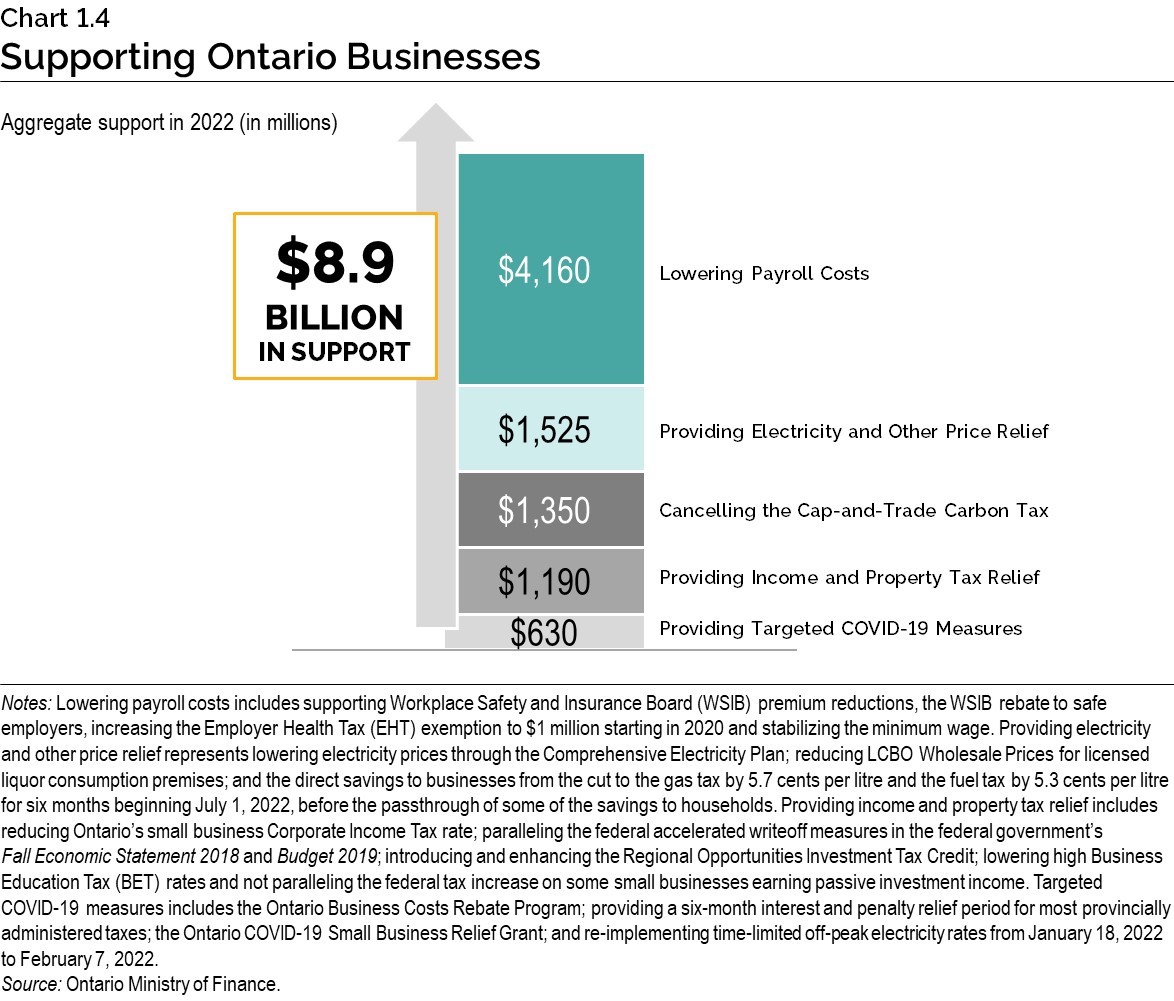

2022 Ontario Budget Chapter 1a

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

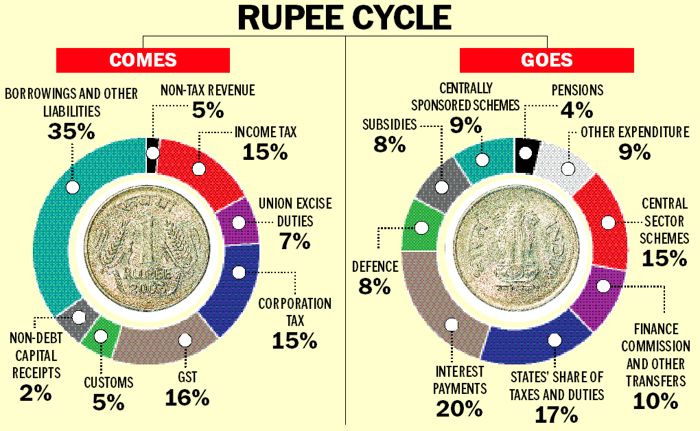

Union Budget 2022 23 Capex Push

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

Biden Tax How Would Biden S Billionaire Minimum Income Tax Work Cbs News

Yes You Can Avoid Real Estate Capital Gains Taxes Here S How

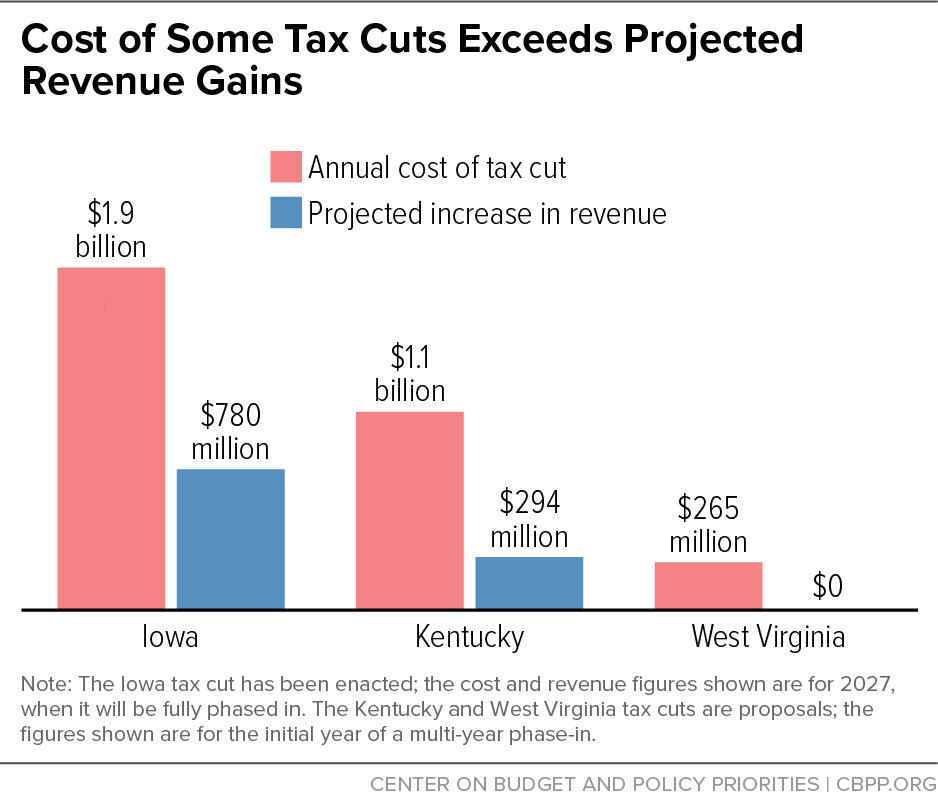

States With Temporary Budget Surpluses Should Invest In People Not Enact Permanent Tax Cuts Center On Budget And Policy Priorities

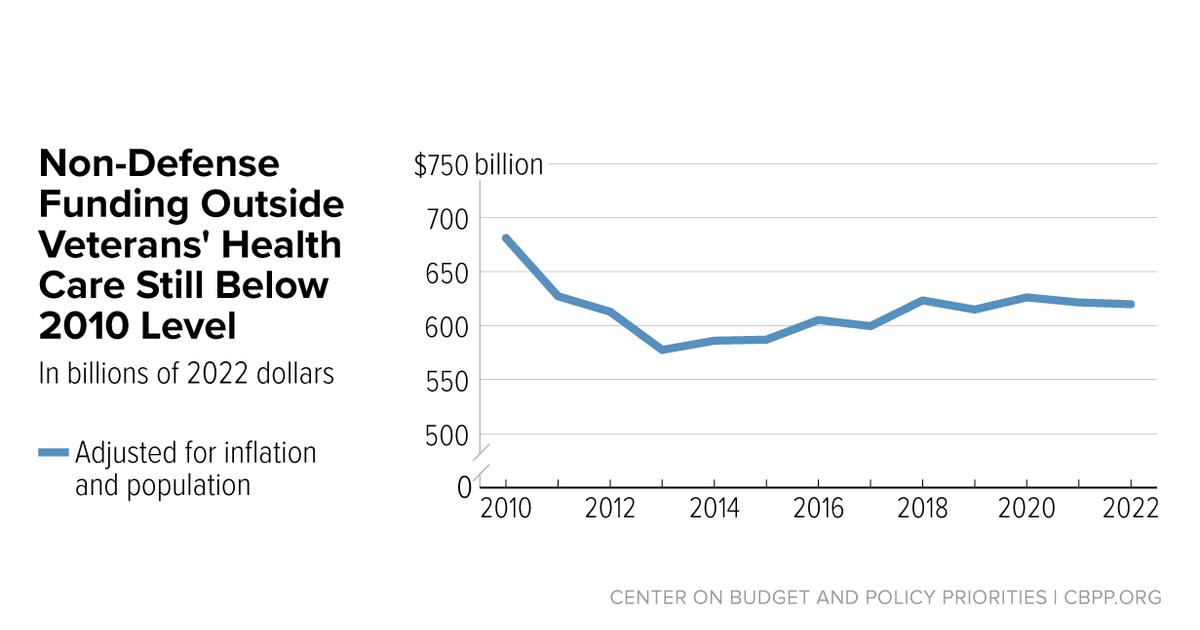

Analysis Of President Biden S 2023 Budget Center On Budget And Policy Priorities

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

There S A Growing Interest In Wealth Taxes On The Super Rich

Canadian Federal Budget 2022 Kpmg Canada

Chapter 9 Tax Fairness And Effective Government Budget 2022

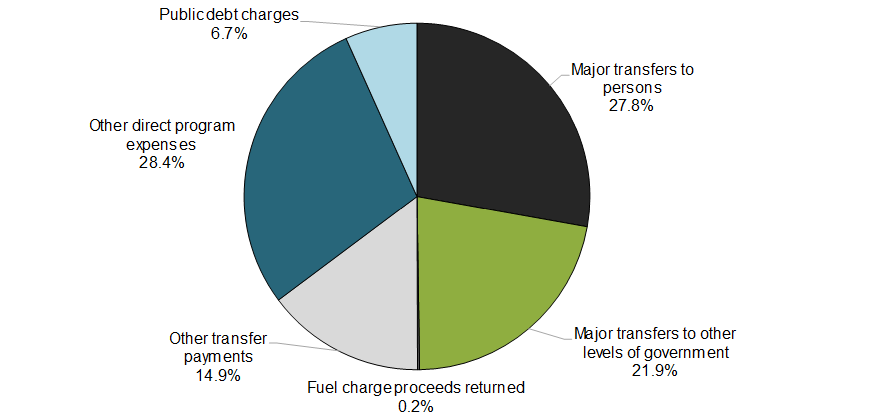

Annual Financial Report Of The Government Of Canada Fiscal Year 2018 2019 Canada Ca